tax on forex trading philippines

Taxation of Resident Foreign Missions and International Organizations. Can you make money trading forex in the Philippines.

Code Of Conduct For Forex Traders In The Works Philstar Com

I am curious to know if there is someone out there who is currently doing forex trading in PH using a foreign broker and who is paying taxes on.

. Here is the maximum capital gains tax rate for individuals in some countries. This means that for a profitable trader 60 of your gains under Section 1256 will be taxed at a reduced rate. The CGT rate for individuals in the UK is 10 for basic rate taxpayers when their total income and capital gains are no more than 50270.

The answer is positive. This is the standard treatment when trading forex options futures. This is because there is no one way in which forex traders are taxed.

Genjo Search ka online ng work from home Aug 20 2021 1130 AM. The remaining 40 will be taxed as short-term capital gains. 2018 DA ITAD BIR Rulings.

Philippines taxes should be filed even if there were losses on the year. Only non-residents may receive an exemption of tax payable on forex earnings. If you trade CFDs then you are subject to capital gains tax CGT on gains you earn from your trading activities.

2017 DA ITAD BIR Rulings. The income generated from outside sources is also taxable in the country. A 360-degree view of forex trading tax has become important for investors.

My answer to that is yes also a forex trader pays taxes on his earned assets. Tax in Philippines for Forex Trading Traders often wonder whether forex trading is subject to taxation in the Philippines. Forex futures and options are 1256 contracts and taxed using the 6040 rule with 60 of gains or losses.

My answer to that is yes also a Forex Trader pays taxes on his earned assets. This is of course different in every country and in some countries you do not pay tax also called a traders paradise. Bhurat sayo Apr 17 2022 0831 PM.

It is legal to use in the Philippines. Ad Were all about helping you get more from your money. It is usually taxed the same way as Capital gains.

A proper understanding of tax on forex trading is important for the trader who. It published an advisory that outlawed forex trading due to fraud and consumer losses. You have to learn to trade on your own kasi marami namang educ materials and tutorials for free.

Trading in stocks in the Philippines is popular but forex trading has a chequered past in the island community. But please dont subscribe to people who are trying to sell you courses for expensive prices. Or nagsasabi na broker daw sila and they will trade for you.

Due to many complaints from consumers the Securities and Exchange Commission SEC in the Philippines cracked down on the industry in 2016. Yes you can make steady profits with forex trading if you trade with effective trading strategies and risk management rules. When it comes to tax on currency trading the investors are often confused under what category their gains will be taxed.

Usman Ahmed MBA Researcher. Lets get started today. Yes forex trading income is taxable in the Philippines.

Genjo Apply ka po work. Forex Trading Forex Taxes in the Philippines. Exchange of Information Program.

In fact the SEC has issued 2 advisories in recent years stating forex trading is illegal to discourage private individuals from trading. Forex Trading Tax Philippines litecoin tradingview. Aspiring forex traders might want to consider tax implications before getting started.

On the other hand if they decide to file their trading earnings under section 1256 in this case 60 of the amount which is 18000 out of 30000 will be taxed at 15 and the remaining 12000 will be taxed at 22. 2019 DA ITAD BIR Rulings. If your total income is 50271 or higher then your profits will be subject to 20 CGT.

My answer to that is yes also a forex trader pays taxes on his earned assets. 2016 DA ITAD BIR Rulings. Press question mark to learn the rest of the keyboard shortcuts.

-United States 37 -Sweden 30 -The Netherlands 31 -Germany 25 -Spain 23. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. PMT Shoutbox Post only questions or comments here.

Press J to jump to the feed. Taxation of Foreign Source Income. Short-term capital gains are taxed at your ordinary income tax rate.

Forex Trading Tax Philippines binär optionen demokonto. For forex trading in the philippines the off hours are the countrys typical working hours which is 200 am to 600 pm.

Best Forex Broker Philippines 2022 Top Ph Forex Brokers List

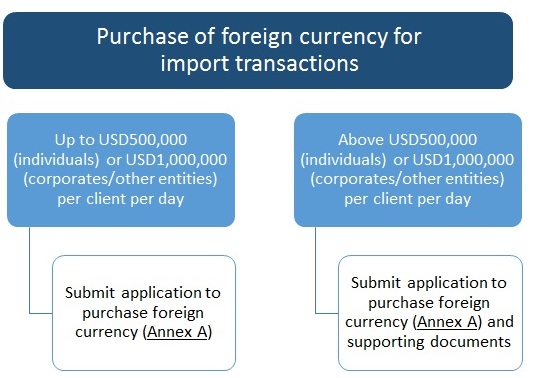

Bangko Sentral Ng Pilipinas Foreign Exchange Regulations Guide To Fx Transactions

Forex Trading Academy Best Educational Provider Axiory

Best Forex Broker Philippines 2022 Top Ph Forex Brokers List

Best Forex Broker Philippines 2022 Top Ph Forex Brokers List

Forex Trading Academy Best Educational Provider Axiory

Forex Trading Academy Best Educational Provider Axiory

Is Forex Trading Legal In The Philippines Forextraderph Com

Best Forex Broker Philippines 2022 Top Ph Forex Brokers List

Forex Trading In The Philippines 2022 The Only Guide You Need

2019 Forex Trading In The Philippines What Is Legal What Is Not Forex Club Asia

Wikifx Report What Is The Average Profit In Forex Trading News Wikifx

Offshore Company For Forex Trading Business Setup Worldwide

/dotdash_Final_Why_the_Forex_Market_Is_Open_24_Hours_a_Day_Sep_2020-01-d2b1c5295a0b4d7a8df8eb057505efb3.jpg)

Why Is The Forex Market Open 24 Hours A Day

Forex Trading 2022 How To Trade Forex Beginners Guide

/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-01-a6be7f7fd3124918a519946fead796b8.jpg)

Most Commonly Used Forex Chart Patterns

Best Forex Broker In India Top 10 Forex Trading Brokers List